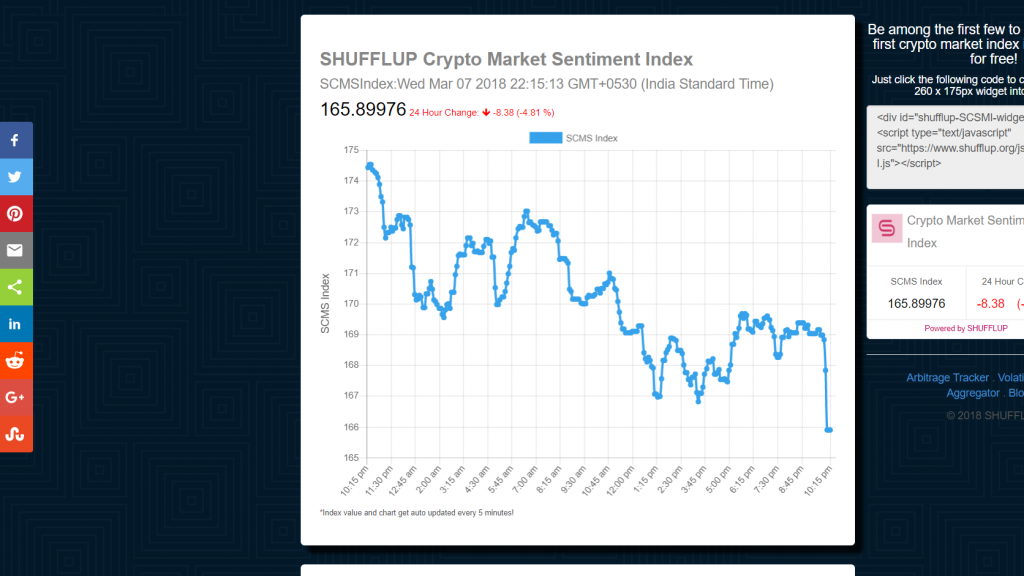

SCMSI — The newest member of our ever growing list of crypto products!

What was the motivation behind it?

Well, we are crypto enthusiasts and we can’t tolerate in any way that the crypto world is behind the traditional stock market! As a result we were taken aback when we noticed that the traditional stock market has Dow Jones Index to monitor the market health but our own crypto world doesn’t have something like that. People generally use the price of Bitcoin as the market health indicator, whereas the truth is that more than 50% of the market is dominated by altcoins. Hence we have developed a market index which takes into account the top 100 coins(based on market capitalization) and gives index points which indicate the market health.

What are you saying? We searched and found a lot of indices.

Of course the crypto world has Weiss Ratings! Just joking! Coming to the point, you might have found a handful of crypto indices scattered here and there. I am going to talk about those and also explain to you why we call ourselves the “world’s first true cryptocurrency market index”.

CCi30 : It is an index which uses the same methodology as S&P 500(only difference is they weigh each component proportionally to the square root of its market capitalization) and takes into account only 30 cryptocurrencies to compute the index. We believe that considering only the top 30 cryptocurrencies to judge market sentiment is not quite correct, specially when we have more than 1500 cryptocurrencies lised on CoinMarketCap and CCi30 is not considering coins such as Komodo, QASH and many more! It is important to mention here that we use the Dow Jones equivalent method to calculate the index.

CRIX : Crix also suffers from the same limitation as CCi30, as in it considers 20 cryptocurrencies as it’s constituents. It is weighted according to the market capitalisation of cryptocurrencies.

CAMCrypto30 : This index also uses the top 30 cryptocurrencies to calculate their index and uses the Russell (e.g., Russell 2000) and FTSE (e.g., FTSE 100) rules.

All the three indices suffer from another common drawback, all of them are re-weighted either on a monthly or a quarterly basis. The problem with this is the ever-changing nature of the crypto world as it races forward in the speed of light and one human month is equivalent to billions of years in the crypto world,if not more. So we believe that re-weighting only once a month is not sufficient because many of the crypto coins or tokens can lose their market capitalisation and may be required to drop from the list of constituents within a few hours. Similarly, because of a reputed ICO a coin can directly make an entry in the top 100 within one day and might be required to get included as the index constituent.

Lastly, please don’t confuse our index with index funds like CRYPTO20, Bitwise or Coinbase index funds because they don’t follow any statistical rule and are simply invented for traders who can invest in the crypto market as a whole. These are not aimed to become parameters for judging the health of the crypto market!

OK, I’ve had enough of your blabbering! Tell me how different(or BETTER) you are from these already existing Indices?

Yes coming straight to our Index, we are different in these three aspects:

- We take into consideration the top 100 cryptocurrencies based on market capitalisation.

- We are the first crypto index equivalent to the Dow Jones index of the traditional market and use price-weighted method to calculate the index(after all, prices of cryptocurrencies are the most important thing in the crypto world, don’t you think so?)

- Last but not the least, our index is re-weighted in REALTIME. Whenever a new cryptocurrency gets introduced or removed from the list of the top 100 coins, our index gets re-weighted.

What do you mean by “Price-weighted”?

To put it simply, we take the arithmetic mean of the prices of the top 100 coins, i.e we take the sum of the prices of all the 100 coins and then divide it by number of coins.

But the real world scenario is not that simple as the crypto world moves at a lightning speed and the members making it to the list of the top 100 coins are also changing very frequently. This introduces a lot of discrepancies in the index value if we follow the above mentioned simplistic model.

What kind of discrepancies does it introduce?

If we follow the simple arithmetic mean model, then whenever a new constituent( member coin) is introduced or removed from the list of the top 100 coins, our index value will change dramatically. For example, suppose a coin of price $50 is replaced by a coin of $500, our index will automatically increase BUT this increase does not reflect the overall improvement in market health.

So, what is the solution?

The solution is to adjust the divisor so that the index doesn’t vary with the inclusion and removal of coins from the top 100 coins’ list. The divisor gets adjusted whenever a member(or constituent) i.e a coin or a token gets changed in the list. What it implies is that addition of a new constituent does not and cannot justify high value variations in the index. Hence immediately after the new constituent is introduced, a new “calculated” divisor value should be simultaneously introduced and we did just that. This is very important because in the fast moving crypto world, the coins which make it to the top 100 keep changing very frequently and hence our algorithm should be self-adjusting. We are happy to tell you that our algorithm does exactly that. The value of the index is calculated every 5 minutes and always done so taking into account the real-time top 100 highest marketCap coins. How do we do it? Let’s take some imaginary coins and create an example based on that!

How the index is calculated?

For this example let us take 3 constituents.

Suppose the price of

Coin A = $10

Coin B = $20

Coin C = $30

So, initially the index would be = (10+20+30)/3 = 20(correct index). After 6 hours the price of B becomes $5.

Now our index is = (10+5+30)/3 = 15(correct index). It reflects the market health correctly as it shows the market is down.

Now after 6 more hours, Coin B loses it’s MarketCap and as a result it is out of the list of the top 3 and is replaced by coin D with $40 price.

So now the index is = (10+40+30)/3 =26.67(wrong index). Our index should not increase just because a new constituent(coin) got added to the list as it does not reflect the correct market health.

So, we would adjust the divisor. Now the new divisor would be (New price summation/last known correct index) = (10+40+30)/15=5.34

The adjusted divisor = 5.34.

Hence the new correct index would be = (10+40+30)/5.34 = 15(you see, just the inclusion of a new coin didn’t change our index which means our index value is correct).

I want more…

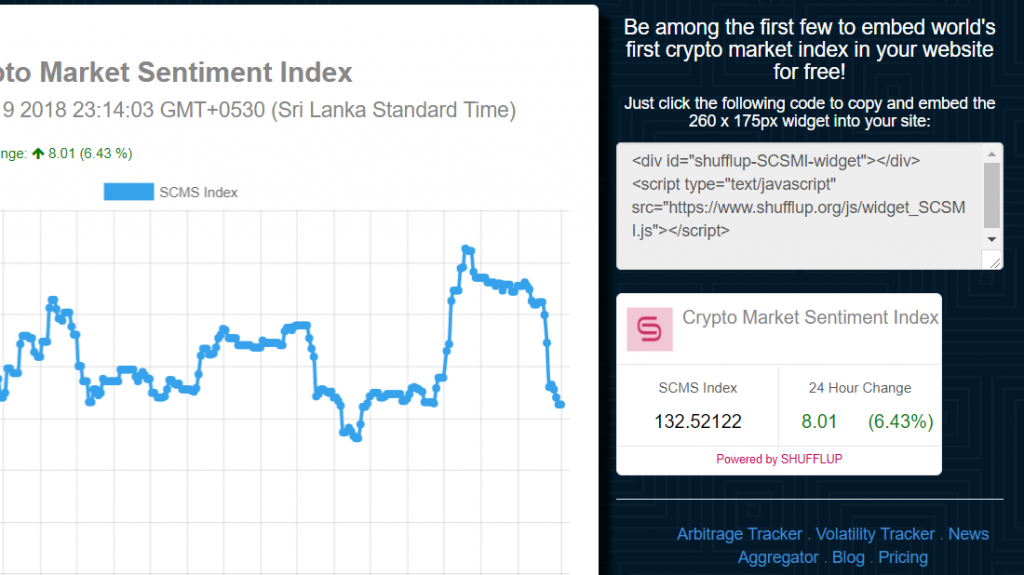

The ADD-ON: Our Index comes with a free embeddable website widget! You can very easily embed it anywhere in your website using just two lines of code and keep an eye on the market health throughout the day. Be among the first few to try it out!

The Funfacts:

- From now on you don’t have to follow the price change of each and every coin to judge whether the overall market is bullish or bearish, rather just follow the SCMS Index.

- You would also be able to compare the profit & loss of your own portfolio with the health of the whole market each day for free.

The Big News:

We again got featured in Product Hunt. Previously we got featured for our Arbitrage Tracker! You can check us out in Product Hunt as well!

Product Hunt page of SHUFFLUP Crypto Market Sentiment Index

Product Hunt page of SHUFFLUP Arbitrage Tracker

We started our journey with the aim of making traders’ lives easier and this is another small step towards it.We hope this would become the benchmark for crypto market analysis in the coming years!

You have heard everything from us and now we would love to hear from you! Any feedbacks, suggestions or questions would be highly appreciated and always welcome. Please leave comments here and I will get back to you as soon as possible!

In the meantime register with us because we have some real big updates just for you!

Written by

Shilpa Mitra, @shilpamitr

Co-founder at SHUFFLUP-Go-to platform for all Cryptocurrency trading and arbitrage related information

Loves to read, write programs to solve problems and about new emerging technologies. When she is doing none of these, she watches cricket and dog videos.